How Does Payment Processing Work?

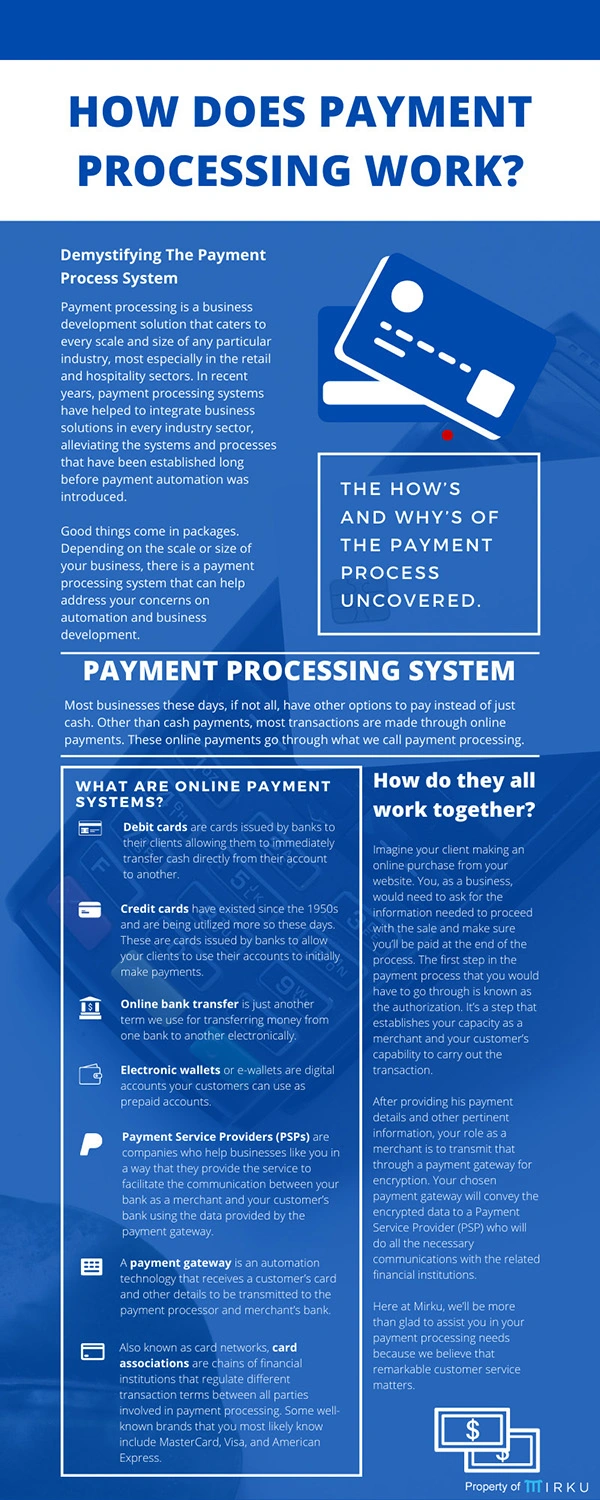

Demystifying The Payment Process System

The how’s and why’s of the payment process uncovered.

Have you ever wondered about the complexities involved in starting a business? Most startups and entrepreneurs will openly share their experiences, however harrowing or difficult it was for them when they began their journey into making their brand known. As daunting as it may seem, starting off a business from the ground up is never easy.

When you’re faced with a competitive market, a volatile economy and a challenge that measures up to your full worth, arming yourself with the proper knowledge will only help to lighten the load. This is where the vital role of business development specialists come into play.

Payment processing is a business development solution that caters to every scale and size of any particular industry, most especially in the retail and hospitality sectors. In recent years, payment processing systems have helped to integrate business solutions in every industry sector, alleviating the systems and processes that have been established long before payment automation was introduced.

Good things come in packages. Depending on the scale or size of your business, there is a payment processing system that can help address your concerns on automation and business development. Let us delve more into the intricacies of the payment processing system, and see what best fits your company.

The Federal Reserve Payment Study (FRPS) made an extensive review that showed the increasing development in non cash payments and further enhancements on other forms of alternative payments. It’s a study regularly made to monitor the changes and developments happening in the U.S. payment systems. According to the survey, the trends in non cash payments showed a continuing decrease in check payments, yet with more than double the increase in other forms of online payments.

To further appreciate the wonders of online payment processing, it’s best to familiarize yourself with the terms involving the ins and outs of the process.

Payment Processing System

Most businesses these days, if not all, have other options to pay instead of just cash. Other than cash payments, most transactions are made through online payments. These online payments go through what we call payment processing.

Unlike the traditional way of doing payments, like what most brick-and-mortar businesses used to do, online payments are the most used form of payment these days. It’s almost exactly the same as handing over cash, it’s just that, it’s done seamlessly over the internet.

Payments are now usually done through a debit or credit card or other online payment systems. If you’re still wondering what revolves around a payment process and how it smoothly moves among individuals and businesses, it’s time to take a look more closely at each of the parties involved.

What Are Online Payment Systems?

Online payment systems are methods of payment that are done electronically in exchange for goods or services bought from a business. These payments are usually done through a debit or credit card. As an example, more than decades ago, when you dine in a restaurant, you probably would have had to withdraw money from an ATM first before entering an establishment.

Now, you can already use the same card that you use for withdrawal, to directly pay with lesser hassle and risks. As technology advances continuously, options for electronic payments are getting broader. There are now other forms of electronic payments such as online bank transfers, electronic wallets, and payment service providers. Below are some other terms used in online payment processing.

Debit Cards

Debit cards are cards issued by banks to their clients allowing them to immediately transfer cash directly from their account to another. These cards are commonly used by your customers as this is one of the oldest ways of doing online banking, along with the use of credit cards.

Credit Cards

Credit cards have existed since the 1950s and are being utilized more so these days. These are cards issued by banks to allow your clients to use their accounts to initially make payments. The bank gives the customer a bank credit that allows them to electronically transact within a certain limit and allows them to pay a transaction without an actual fund and is payable to the bank at a later date.

Online Bank Transfer

Online bank transfer is just another term we use for transferring money from one bank to another electronically. Online bank transfer transactions are usually done instantly but sometimes can take up to a few hours depending on the regulations of the banks involved.

Electronic Wallet

Electronic wallets or e-wallets are digital accounts your customers can use as prepaid accounts. It’s a system that uses your client’s information to keep their funds and be available for use as payment for online purchases. It’s basically called a wallet as it gives the privilege of making virtual cash transfers without the physical presence of cash. It’s also similar to a debit card, except that the fund is not stored in a bank account.

Payment Service Providers

Payment Service Providers (PSPs) are companies who help businesses like you in a way that they provide the service to facilitate the communication between your bank as a merchant and your customer’s bank using the data provided by the payment gateway. They are the ones working with all the parties involved in online payment transactions and are also known as payment processors.

Payment Gateway

A payment gateway is an automation technology that receives a customer’s card and other details to be transmitted to the payment processor and merchant’s bank. They provide data encryption to avoid threats that may be taken from the card itself.

Card Associations

Also known as card networks, card associations are chains of financial institutions that regulate different transaction terms between all parties involved in payment processing. Some well-known brands that you most likely know include MasterCard, Visa, and American Express.

How Do They All Work Together?

Imagine your client making an online purchase from your website. You, as a business, would need to ask for the information needed to proceed with the sale and make sure you’ll be paid at the end of the process. The first step in the payment process that you would have to go through is known as the authorization. It’s a step that establishes your capacity as a merchant and your customer’s capability to carry out the transaction.

After providing his payment details and other pertinent information, your role as a merchant is to transmit that through a payment gateway for encryption. Your chosen payment gateway will convey the encrypted data to a Payment Service Provider (PSP) who will do all the necessary communications with the related financial institutions.

The PSP will make a request from the card network who will do the verification with your customer’s account provider. The account provider will then approve or reject the request depending on the status of his account and will relay the intended message to your bank as a merchant.

To maximize your cost-efficiency as a merchant, all the authorized requested transactions of the day are pooled together before forwarding them to a PSP. The PSP will transact with the card association who will request a fund debit from your customer’s account provider. That provider will charge the amount from his account with the necessary interchange fees and will then be transferred to your bank account. You being paid for your product or service is the final and most important step in the whole payment process and is also known as the settlement or funding.

By further simplifying the not-so-complicated payment processing, it gives you the edge in offering payment flexibility, superb convenience, and reliable security through contactless services. This modern system of payment is favorable in the sense that it saves you time and manages your costs.

What Payment Processing System is sure to bring forth to your industry is the value of what automation means for you and your customers. A high value experience that can lead to long-term positive customer relations.

Here at Tize, we’ll be more than glad to assist you in your payment processing needs because we believe that remarkable customer service matters.